In the digital age, having a strong online presence is no longer optional for professionals, including tax advisors. This comprehensive guide delves into why a professional website is crucial for tax advisors, the benefits it brings, and the essential components that make a tax advisory website effective and successful.

## What You Will Learn:

- **The 5 Whys of Creating an Effective Website**

- **The Importance of a Professional Website**: Understand why a digital presence is crucial for tax advisors in today's digital age.

- **Benefits of Having a Website**: Explore the tangible advantages a website provides to your tax advisory service.

- **Key Components of an Effective Website**: Learn about the essential features and functionalities that make a tax advisory website stand out and effectively serve clients.

## The 5 Whys Analysis to Understand the True Value Behind Creating an Effective Website for a Tax Advisor

1. **Why create an effective website?** To establish a professional online presence. In today’s digital age, clients often start their search for services online. A professional website acts as the digital front door for tax advisors, making them easily accessible to potential clients.

2. **Why establish a professional online presence?** To build credibility and trust among potential clients. A well-designed website with professional credentials, client testimonials, and detailed service offerings can significantly enhance a tax advisor's credibility. This trust is crucial in the financial sector, where clients need to feel confident in their advisor's expertise and integrity.

3. **Why is it important to build credibility and trust?** To differentiate from competitors. The tax advisory market is crowded, and a credible, trustworthy online presence can set a tax advisor apart from others. This differentiation is key to attracting clients who are looking for high-quality, reliable tax advice and services.

4. **Why differentiate from competitors?** To attract and retain a higher quality and quantity of clients. When clients perceive a tax advisor as credible and trustworthy, they're more likely to engage their services. A well-designed website not only attracts new clients but also helps retain them by facilitating easy access to valuable resources, advice, and the ability to contact the advisor directly.

5. **Why attract and retain higher quality and quantity of clients?** To achieve business growth and sustainability. Attracting and retaining clients leads to increased revenue, referrals, and the opportunity to expand services. For tax advisors, business growth also means the ability to invest in further professional development, technology to improve service delivery, and potentially hire additional staff to meet the needs of an expanding client base.

## Benefits of Having a Website for Your Tax Advisory Service

1. **Establish Authority in Your Niche**: A website filled with insightful articles, case studies, and regulatory updates positions you as an authority, distinguishing you from competitors.

2. **Attract and Retain Quality Clients**: High-quality content and a user-friendly interface cater to the needs of potential clients, encouraging them to choose your service and stay loyal.

3. **Automate and Simplify Client Interactions**: Online booking, form submissions, and FAQs can streamline interactions, making the client journey smoother and more efficient.

4. **Attract Top Tax Specialists**: A professional website showcases your firm as a leader in the field, attracting top talent eager to work with the best.

## Key Components of an Effective Tax Advisory Website

### Site Architecture

**What**: The blueprint of your website, defining how content is organized and presented.

**Why**: Good architecture enhances user experience, making information easy to find and navigate.

**How**: Use clear, logical navigation with a hierarchy that reflects your services’ priorities.

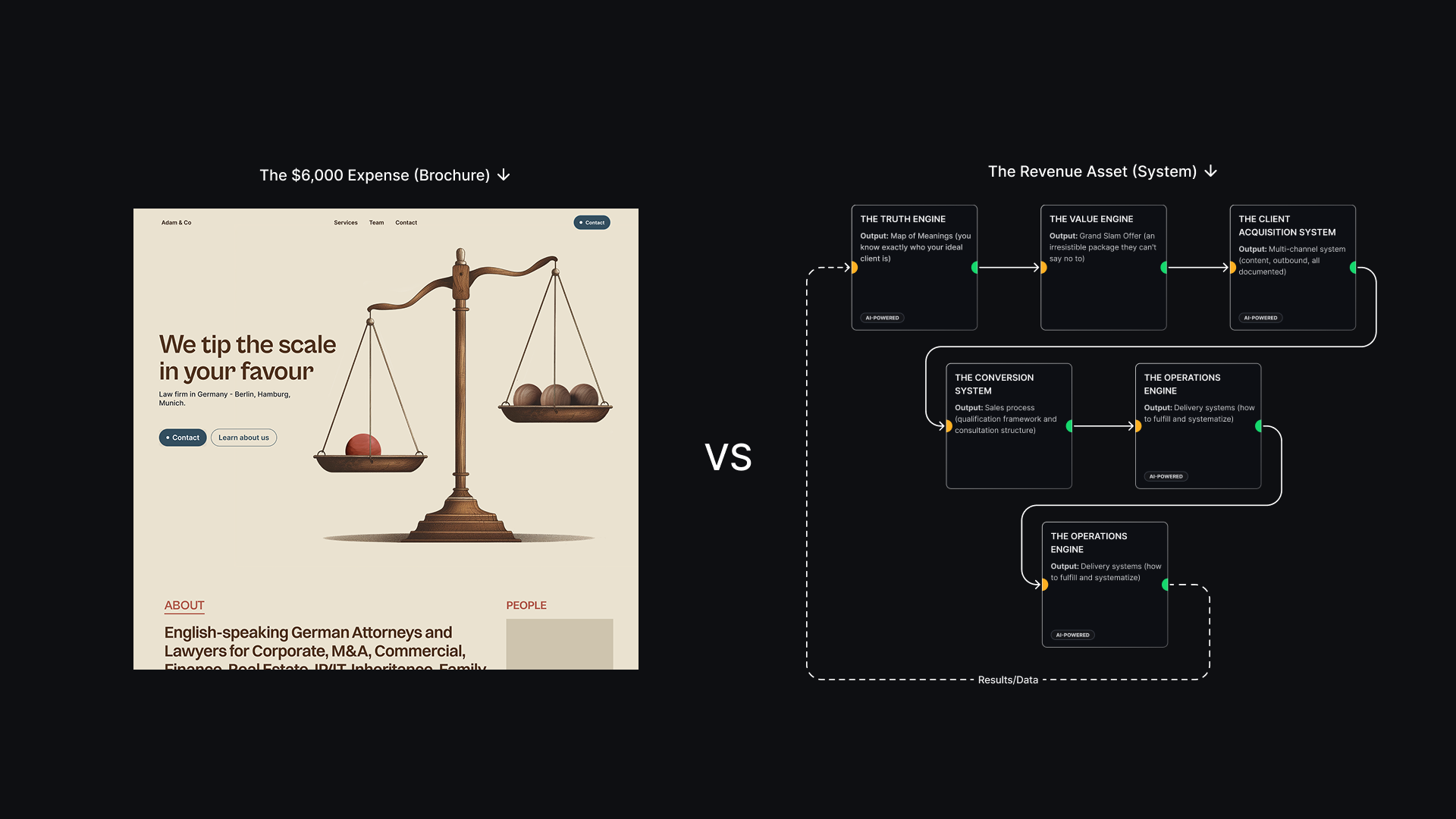

### Design

**What**: The visual aspect of your website, including layout, color scheme, and typography.

**Why**: Design influences first impressions, affects usability, and reflects your brand identity.

**How**: Opt for a clean, professional design that aligns with your brand and is appealing to your target audience.

### Perception

**What**: The impression your website leaves on visitors, influenced by design, content, and usability.

**Why**: Positive perception builds trust and credibility, crucial for converting visitors into clients.

**How**: Ensure your website is professional, informative, and user-friendly.

### Content Structure

**What**: The organization of content on your website, ensuring it is informative and easily accessible.

**Why**: Well-structured content improves user experience and supports SEO efforts.

**How**: Organize content with clear headings, subheadings, and bullet points; include a mix of text, images, and videos for engagement.

### Practical and Useful Content

**What**: Content that provides real value to visitors, such as tax tips, industry news, and how-to guides.

**Why**: Useful content establishes authority, helps with SEO, and encourages repeat visits.

**How**: Regularly update your website with original content that addresses your clients' needs and questions.

### SEO

**What**: The practice of optimizing your website to rank higher in search engine results.

**Why**: Higher visibility in search results leads to more traffic and potential clients.

**How**: Use relevant keywords, optimize meta tags, and ensure your website is mobile-friendly.

### Performance

**What**: The speed and efficiency with which your website loads and operates.

**Why**: Fast-loading pages improve user experience and are favored by search engines.

**How**: Optimize images, leverage browser caching, and minimize the use of heavy scripts.

### Responsiveness

**What**: The ability of your website to adapt to different screen sizes and devices.

**Why**: With the increasing use of smartphones, a mobile-friendly website is essential for accessibility.

**How**: Use responsive design techniques to ensure your website looks and functions well on all devices.

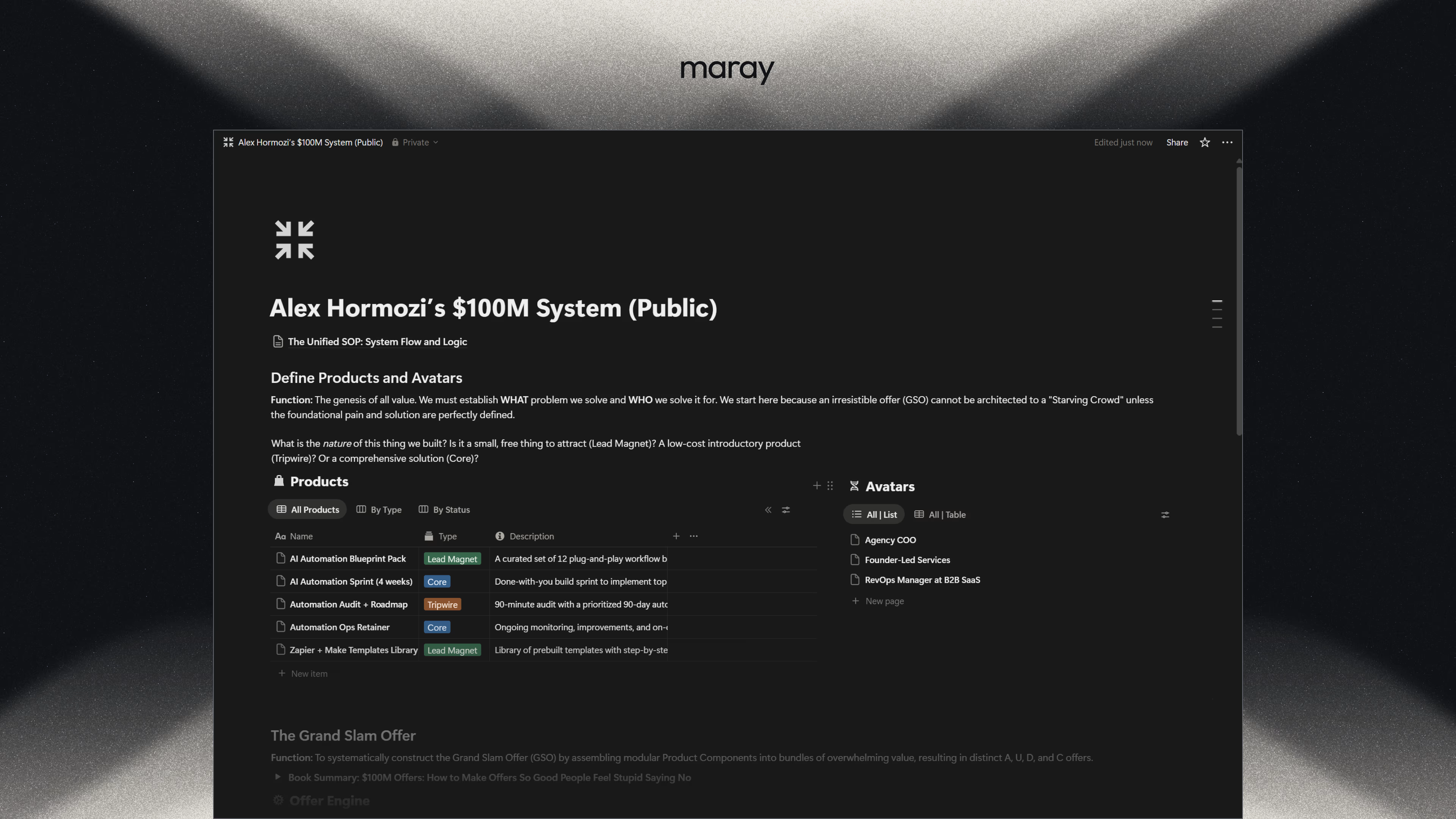

### Automation (Booking, Forms, CRM)

**What**: Incorporating automated features such as online booking, form submissions, and customer relationship management (CRM) systems.

**Why**: Automation enhances efficiency, improves client satisfaction, and reduces administrative workload.

**How**: Integrate reliable software solutions for scheduling, client inquiries, and managing client data securely.

## Conclusion

For tax advisors, a professional website is not just a tool for digital presence but a cornerstone for business growth, client engagement, and establishing authority in the tax advisory field. By understanding and implementing the key components outlined in this guide, tax advisors can create a website that not only meets but exceeds the expectations of modern clients, setting the stage for long-term success in the digital landscape.